Petrodollars, Pax Americana, Offshore Dollars, Dollar Recycling, and the Yen Carry as One Integrated System

Executive Premise

This paper does not ask whether the US dollar is “good” or “bad,” nor does it speculate on ideological decline.

It does something far more useful:

It explains how the dollar system actually works as an engineered structure,

why it continues to dominate global finance,

and through which channels it amplifies both booms and crises.

The dollar order is not sustained by belief.

It is sustained by interlocking balance-sheet mechanics.

Those who fail to understand this mistake symptoms for causes, and narratives for mechanisms.

I. First Principles: The Dollar Order Is an Engineered System

Most discussions of the dollar start from the wrong abstraction layer.

They begin with:

- “US power”

- “Dollar hegemony”

- “Reserve currency status”

These are descriptions, not mechanisms.

The dollar order persists because it solves four structural problems simultaneously:

- Global security coordination

- Commodity pricing and settlement

- Cross-border credit creation

- Crisis-time liquidity backstopping

No other currency system currently solves all four at scale.

That is the starting point. Everything else is downstream.

II. Pax Americana: The Real Base Layer of the Dollar System

1. Security Is the Invisible Collateral

Global finance does not function in a vacuum.

It requires predictable enforcement of:

- trade routes

- contracts

- financial infrastructure

Pax Americana is not a slogan. It is implicit collateral.

It provides:

- maritime security for energy flows

- geopolitical guarantees for allies

- enforcement power behind legal and financial institutions

In finance, trust is not emotional.

It is credible commitment under stress.

Markets do not ask who is morally right in a crisis.

They ask who can absorb losses and still function.

2. Why Reserve Status Is Not About Savings

A common myth is that reserve currencies dominate because foreigners “save in them.”

The reality is harsher:

Reserve currencies dominate because global balance sheets depend on them during stress.

The dollar is not primarily a store of value.

It is the unit of account for systemic survival.

III. The Petrodollar: Not a Contract, but a Path Dependency

1. The Petrodollar Is Widely Misunderstood

There is no secret treaty mandating oil be sold exclusively in dollars.

What exists instead is far more durable:

A deeply entrenched settlement path linking energy trade to dollar liquidity and hedging infrastructure.

Energy markets require:

- deep futures markets

- large, liquid collateral pools

- stable clearing mechanisms

The dollar developed these first and deepest.

Once such a system exists, abandoning it is costly even if alternatives are politically attractive.

2. What the Petrodollar Actually Does

The petrodollar mechanism performs two structural functions:

Function A: Structural Dollar Demand

Any energy-importing economy must touch the dollar system, directly or indirectly.

Even when bilateral settlement currencies change, the dollar remains the intermediary.

This creates unavoidable transactional demand.

Function B: Surplus Recycling Pressure

Energy exporters accumulate dollars.

These balances must be placed somewhere:

- US Treasuries

- US credit markets

- global banking deposits denominated in dollars

Thus, trade surpluses are transformed into financial capital.

This is not ideology. It is balance-sheet gravity.

IV. Dollar Recycling: Why US Deficits Are Not a Bug

1. The Paradox of Persistent US Deficits

Conventional economics treats persistent current-account deficits as unsustainable.

Yet the US has run them for decades without currency collapse.

Why?

Because the dollar system converts deficits into global assets.

2. The Recycling Loop

The loop operates as follows:

- US imports more than it exports

- The world receives dollars

- Those dollars must be invested

- US financial markets offer unmatched depth and liquidity

- Capital flows back into US assets

- Financing costs fall

- Asset issuance expands

- The cycle reinforces itself

The US is not “free-riding.”

It is hosting the global balance sheet.

3. The Cost of Hosting the System

This privilege is not free.

It creates:

- asset price inflation

- financialization

- sensitivity to global shocks

The US absorbs volatility so others do not have to.

This is why global crises feel “American,” even when they originate elsewhere.

V. The Core Engine: Offshore Dollars (Eurodollars)

If petrodollars are the intake valve, offshore dollars are the circulatory system.

Ignoring them guarantees misunderstanding.

1. What Offshore Dollars Are

Offshore dollars are dollar liabilities created outside the United States, primarily by non-US banks.

They are:

- not physical cash

- not central-bank reserves

- not directly regulated by US domestic rules

They are bank balance-sheet instruments.

2. Why They Exist

They exist because global trade and finance require more dollars than the US banking system alone can supply.

Offshore creation:

- increases dollar availability

- lowers global financing costs

- expands credit capacity

This is efficient in good times.

3. Why They Are Fragile

Offshore dollar creation relies on:

- wholesale funding

- FX swaps

- repo markets

These instruments are confidence-sensitive.

When risk rises:

- funding evaporates

- margins rise

- dollar liquidity collapses

This is the true origin of “global dollar shortages.”

VI. Crisis Reality: Who Backs the Offshore Dollar System?

Here lies the system’s deepest truth.

Offshore dollars behave like private credit in expansion

and like public goods in crisis.

When stress hits:

- only central banks can stabilize them

- only the Federal Reserve has the capacity to do so globally

This is why swap lines matter more than speeches.

The dollar system is not purely market-based.

It is a hybrid public-private structure.

VII. Europe and the Dollar Constraint

Europe’s relationship with the dollar illustrates the system’s limits.

European banks:

- hold vast dollar assets

- lack stable dollar deposits

This mismatch forces reliance on:

- FX swaps

- dollar funding markets

- Fed liquidity in crises

The euro did not fail because it is weak.

It failed because it lacks a unified fiscal and liquidity backstop comparable to the US system.

Markets price this brutally and without ideology.

VIII. The Yen Carry: The Dollar System’s Turbocharger

Now to the component traders feel most viscerally.

1. Why the Yen Became the Funding Currency

Japan offers:

- persistently low rates

- deep financial markets

- predictable policy behavior

This makes the yen ideal for funding.

2. How the Carry Trade Works Structurally

In simple terms:

- borrow yen

- convert to dollars

- buy higher-yielding assets

In complex reality:

- layered leverage

- derivatives overlays

- cross-currency basis risk

The carry trade:

- amplifies risk appetite

- inflates asset prices

- suppresses volatility

Until it doesn’t.

3. Yen Strength as a Global Deleveraging Signal

When the yen strengthens sharply, it is rarely about Japan.

It signals:

- funding stress

- forced unwinds

- balance-sheet contraction

The yen is not a currency indicator.

It is a global risk barometer.

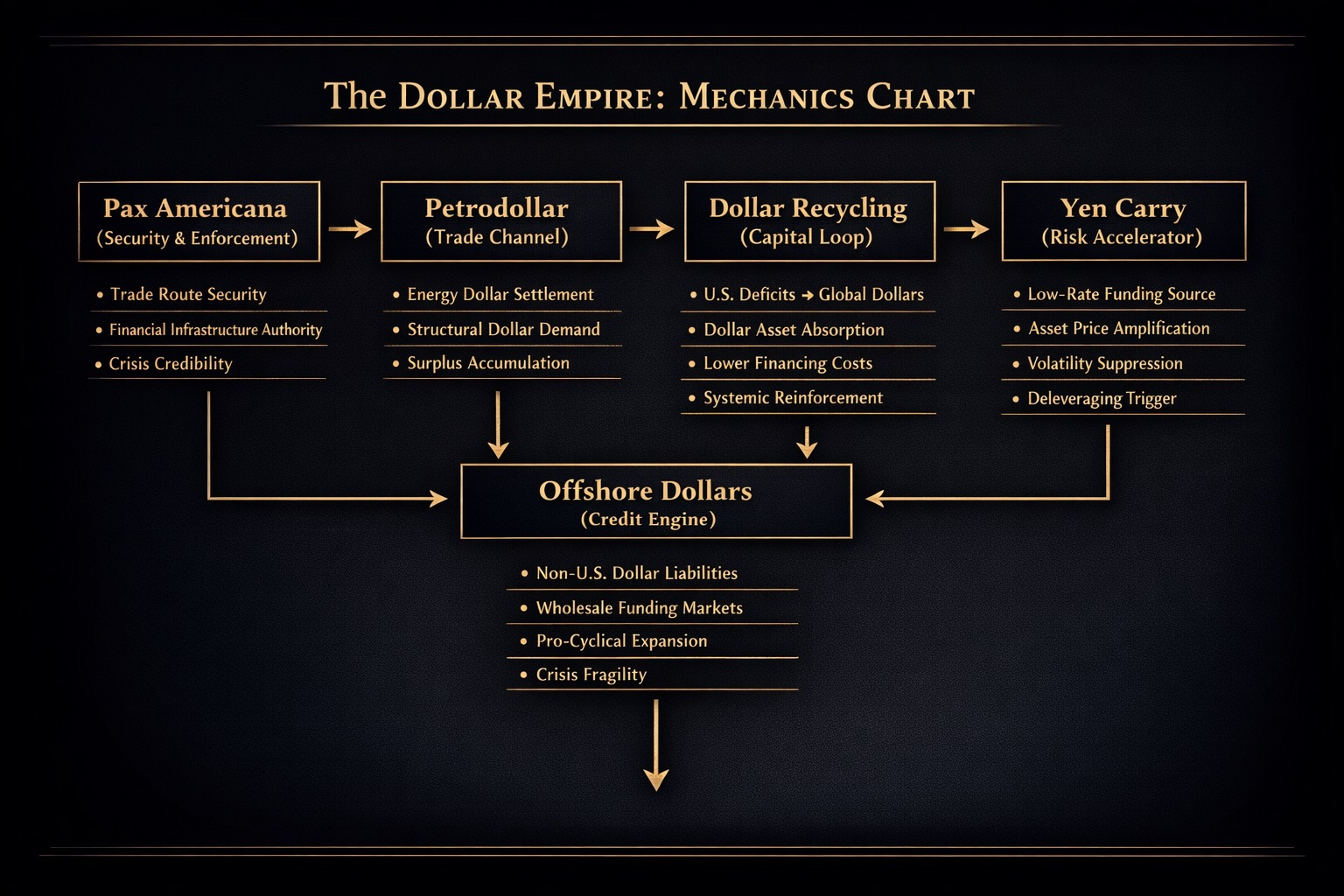

IX. Integrated Text-Tree Framework

The Dollar Empire

├─ Pax Americana (Security & Enforcement)

│ ├─ Trade route security

│ ├─ Financial infrastructure authority

│ └─ Crisis credibility

│

├─ Petrodollar (Trade Channel)

│ ├─ Energy dollar settlement

│ ├─ Structural dollar demand

│ └─ Surplus accumulation

│

├─ Dollar Recycling (Capital Loop)

│ ├─ US deficits → global dollars

│ ├─ Dollar asset absorption

│ ├─ Lower financing costs

│ └─ Systemic reinforcement

│

├─ Offshore Dollars (Credit Engine)

│ ├─ Non-US dollar liabilities

│ ├─ Wholesale funding reliance

│ ├─ Pro-cyclical expansion

│ └─ Crisis fragility

│

└─ Yen Carry (Risk Accelerator)

├─ Low-rate funding source

├─ Asset price amplification

├─ Volatility suppression

└─ Deleveraging trigger

X. Logical Derivation Chain (For Allocation & Risk)

Premise 1: Global trade and finance still require dollar settlement

→ Dollar demand is structurally embedded

Premise 2: Offshore dollar creation dominates global liquidity

→ Fed policy alone does not define dollar conditions

Premise 3: Offshore dollar funding is fragile

→ Crises manifest as dollar shortages

Premise 4: The Fed is the ultimate backstop

→ The dollar system has public-good characteristics

Premise 5: The yen funds global risk

→ JPY moves reflect systemic stress, not domestic narratives

Conclusion: This Is Only the Beginning

This paper answered one question only:

How the dollar empire works today.

It did not answer:

- where it fractures

- how it mutates

- how assets reprice when its assumptions fail

That is the purpose of Part II and Part III.

If you are reading this, you are not here for opinions.

You are here because when the machine changes, prices change first.

This paper is your schematic.

The Dollar Empire Trilogy · Part I — End

If you want, next we build Part II: Stress Fractures and Failure Modes,

with explicit mappings to rates, FX, equities, commodities, and volatility.

No optimism. No doom. Just mechanics.