0. Prologue: Why Volatility Matters More Than Direction

Most retail traders believe options are about choosing whether a stock “goes up or down.”

Professionals know this is childish.

Direction is only one variable.

Volatility is the entire pricing engine.

Time is the silent tax collector.

Professionals trade distributions, not predictions.

We trade variance, not vibes.

We trade probability clusters, not hunches.

This chapter exists to break your mind out of the directional trap and push you into the intellectual world where real PnL comes from:

the world of Implied Volatility (IV).

If you master IV, everything else becomes simple.

If you fail to understand IV, you will always be the liquidity, never the trader.

Let’s start where professionals start:

with the actual drivers of option pricing.

1. What Implied Volatility Actually Represents

Forget the classic textbook explanation (“IV measures expected future volatility”).

That is technically correct but practically useless.

Professionals view IV as:

The market’s consensus on uncertainty — monetized.

IV is not a forecast.

IV is a price for uncertainty.

When you buy an option, you’re not buying “up or down.”

You’re buying the market’s expectation of how violently price can move.

When you sell an option, you’re not selling “up or down.”

You’re selling uncertainty to buyers who think they need it.

IV = Fear + Time + Liquidity + Positioning distilled into one number.

A single number that tells you:

- How expensive options are

- How much movement is already priced in

- Whether you should be a buyer or seller

- Whether your trade has positive or negative expectancy

Professional traders often phrase it simply:

High IV = insurance is expensive → be the insurer.

Low IV = insurance is cheap → buy lottery tickets.

2. Why Direction Is a Minor Variable in Options Trading

Let me tell you a story every fund teaches new traders:

Two traders buy the same call option.

- The underlying moves up.

- One trader makes +180%.

- The other loses –25%.

Same symbol. Same direction. Same expiry. Same strike.

Different results.

Why?

Because

IV collapsed

, and the second trader bought volatility at the wrong price.

The market moved, but it didn’t move enough to justify the premium he paid.

This destroys retail traders over and over.

They think options are about “guessing direction.”

No. That’s the least important variable.

Professionals focus on:

- Volatility Regime

- Volatility Relative Value (IV Rank, IV Percentile)

- Curvature of the Vol Surface

- Term Structure

- Catalyst-adjusted expected move

- Dealer positioning & Gamma exposure

Direction is only the 5th or 6th thing that matters.

3. The Core Formula: IV → Expected Move → Fair Price

To understand options like a trader, burn this into your brain:

IV → expected move → fair price → strategy selection

Vol dictates:

- how far the market expects price to move

- how expensive options are

- whether buying or selling vol makes sense

Professionals never ask:

“Will SPX go up or down?”

They ask:

“Will SPX move more or less than what IV is pricing?”

This framework separates gamblers from traders.

Because if the market expects a 4% move and you only get 1.5%, your long options bleed to death even if the direction is correct.

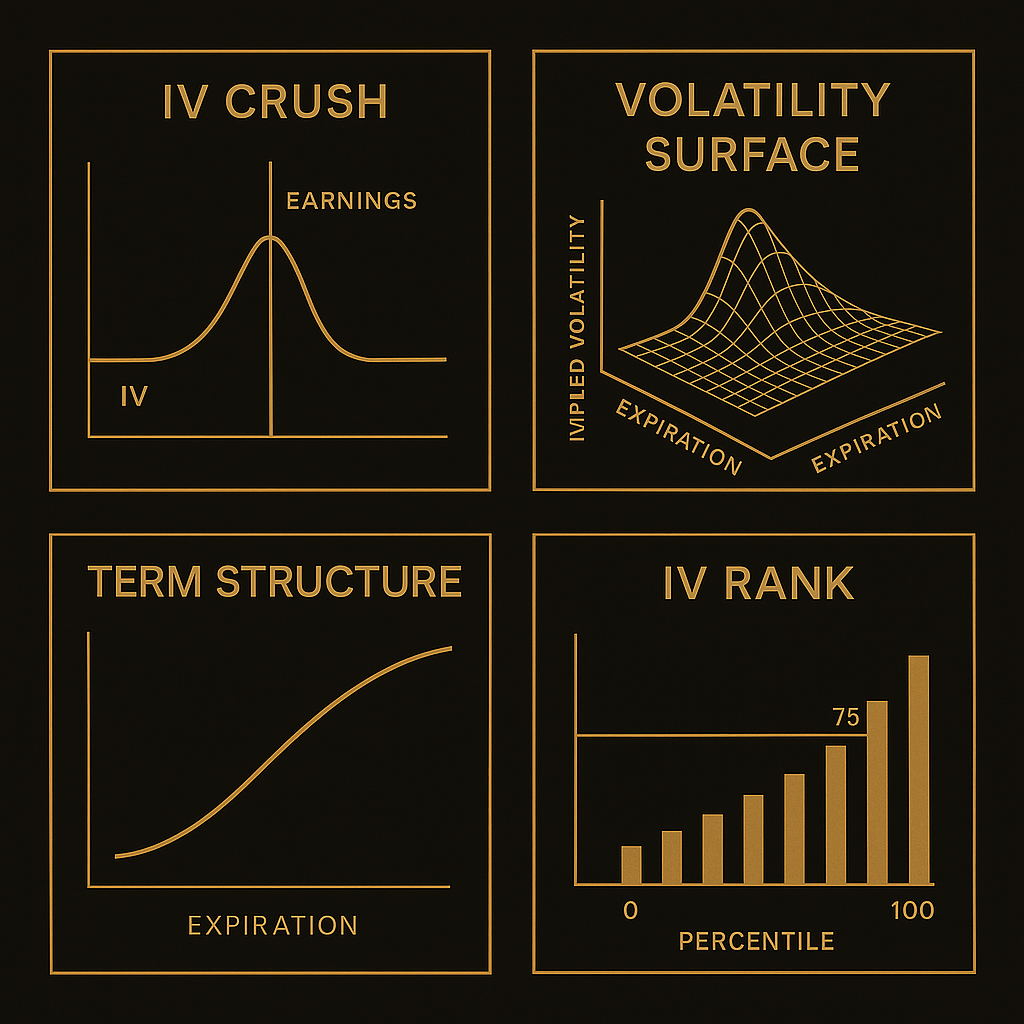

4. IV Crush — Why Most Retail Trades Lose Money

Earnings week illustrates the entire concept perfectly.

Before earnings:

- Uncertainty is high

- IV spikes

- Options become expensive

After earnings:

- Uncertainty disappears

- IV collapses

- Even correct directional calls can lose money

This is IV Crush.

It wipes out beginners with surgical precision.

And it’s not limited to earnings:

- CPI

- FOMC

- NFP

- BOJ

- ECB

- Wars

- Fed speakers

- Regulatory decisions

- Geopolitical shocks

Before any major catalyst → IV expands.

After → IV dies.

Professionals don’t fear IV Crush.

We harvest it.

We sell when people overpay for uncertainty.

We buy when volatility is mispriced relative to realized movement.

This is not gambling — it’s insurance pricing.

5. The Real Reason Markets Move: Volatility Regimes

Markets aren’t linear.

They move in volatility regimes:

1. Low Vol Regime (IV cheap, realized vol low)

- Market smooth

- Grind-up or range-bound

- Trend-followers thrive

- Option sellers print money

- Gamma hedging suppresses price swings

2. High Vol Regime (IV expensive, realized vol high)

- Market violent

- Gaps everywhere

- Retail dies

- Professionals make fortunes

- Market becomes disorderly

- Gamma positioning accelerates moves

3. Transition Regime (IV rising)

- Fear enters slowly

- RV > IV

- Best time to buy options

- Opportunities for outsized returns

Professional traders aren’t predicting markets.

We’re detecting regimes.

Because regime determines:

- strategy

- sizing

- expiry

- strike selection

- risk profile

- whether we’re net buyers or sellers

- whether we need convexity or decay

Without regime detection, options trading becomes pure chaos.

6. IV Rank, IV Percentile, and Comparative Vol Analysis

To be a professional, you need relative analysis.

6.1 IV Rank

Shows where IV sits relative to its 1-year high/low.

- IV Rank 0–20 → options cheap

- IV Rank 50 → neutral

- IV Rank 80+ → expensive

This tells you whether you should:

- Buy (when IV cheap)

- Sell (when IV expensive)

6.2 IV Percentile

Shows how often IV was lower than current IV.

If IV percentile = 90%, IV is extremely high relative to history.

Use negative-theta strategies:

- short strangles

- short puts/calls

- iron condors

- calendars

- diagonal spreads

If IV percentile = 10%, IV is cheap:

- long calls

- long puts

- debit spreads

- calendars (IV rising expected)

6.3 Comparative Volatility

Comparing IV across:

- sectors

- asset classes

- related symbols

- correlated pairs

- FX triangles

- commodity curves

This is where professionals scalp volatility mispricing.

Example:

If SPX IV is cheap but VIX futures elevated, opportunities exist.

Or:

If AAPL IV is cheap while QQQ IV elevated, spreads open.

7. Volatility Surface: The True Map of the Options Market

You cannot be a real options trader without understanding the vol surface.

The vol surface has three dimensions:

- Strike

- Expiry

- Implied volatility

The curvature and slope tell you:

- Where demand is

- How institutions are hedging

- Where risks cluster

- Where the market expects asymmetry

- How pricing is distorted by supply/demand imbalances

Professionals extract edge from:

- Vertical skew (OTM puts expensive, tails heavy)

- Horizontal skew (longer expiries smoother)

- Forward vol

- Vol-of-vol

- Term structure steepness

If this sounds complicated, here’s the translation:

The vol surface is the fingerprint of market fear.

Learn to read it, and you see what retail cannot.

8. The Five Professional Uses of IV

8.1 Identify mispriced risk

When IV is too low → buy options.

When IV is too high → sell options.

8.2 Build convexity

Convexity = the thing that makes you rich.

Professionals buy options not for direction,

but for outsized, asymmetric non-linear returns.

8.3 Hedge portfolio risk

Funds buy puts systematically.

Volatility is an asset class.

8.4 Infer positioning

High skew → institutions fear downside.

Flat skew → complacency.

Backwardation → stress events.

Contango → normal regime.

8.5 Identify catalysts

When IV expands:

the market is pricing in fireworks.

When IV collapses:

the market is relaxed or incorrect.

9. How Professionals Actually Trade Volatility

Here are real institutional frameworks:

9.1 Long Vol Strategies

- Long straddle

- Long strangle

- Calendar spreads

- Diagonals

- Backspreads

- Tail hedges

Used when:

- RV > IV

- Big catalyst approaching

- Low vol regime ending

9.2 Short Vol Strategies

- Short strangle

- Short put/call

- Iron condor

- Covered calls

- Cash-secured puts

Used when:

- IV overpriced

- Market range-bound

- Vol surface dislocated

9.3 Vol Arbitrage

Pros love:

- Long RV / Short IV

- Dispersion trades

- Relative value vol

- Skew trades

- Calendar shape trades

These are the trades that print money quietly while retail yolo’s zero-DTE options.

10. The Single Most Important Insight for a New Options Trader

Here it is:

The underlying does not need to move for you to make or lose money.

Only volatility needs to move.

This one sentence separates amateurs from traders.

If you internalize this, everything opens:

- you stop chasing direction

- you start thinking probabilistically

- you stop overpaying

- you stop buying weekly options

- you stop losing to IV crush

- you start controlling your risk

- you start thinking like an insurer or volatility supplier

Most traders never learn this.

That’s why most lose.

11. Practical Framework: How to Use IV in Real Trading

When to BUY options (long vol):

- IV low

- Term structure flat

- Catalyst approaching

- Underlying compressing volatility

- RV > IV (realized vol higher than implied)

When to SELL options (short vol):

- IV high

- IV percentile high

- IV Rank elevated

- Vol surface steep

- Mean reversion expected

- Post-catalyst environment

When to stay out:

- Term structure inversion

- Vol-of-vol high

- Dealer positioning unstable

- Liquidity fractured

- No edge in RV–IV spread

Professionals don’t trade because “it looks bullish.”

Professionals trade because IV says the trade is priced incorrectly.

12. Closing: Volatility Is the Real Market

You now understand what most traders never do:

- Price ≠ market

- Charts ≠ market

- Predictions ≠ market

The real market is volatility.

Price is just the shadow it casts.

If you master volatility, you master:

- direction

- timing

- risk

- convexity

- expectancy

- premium decay

- edge extraction

Without volatility, options make no sense.

With volatility, options become a superpower.