金价昨日发生巨幅下跌,高盛交易员称之为“幕后操纵”,整个市场都出现了仓位动荡,而多头动量指标也面临真正的压力,高盛动量指标对在动量多头下跌 3% 和动量空头上涨 2% 的双重打击下暴跌 5%。

What was seemingly a quiet day for the major indexes, was anything but below the surface, with positioning driven turmoil across the board in what Goldman described were "funky moves" under the hood, as well as real pressure on Long Momentum names, as the Goldman Momentum Pair imploded 5% lower with the double whammy of Momentum Long -3%, and the Momentum Short ripping +2%.

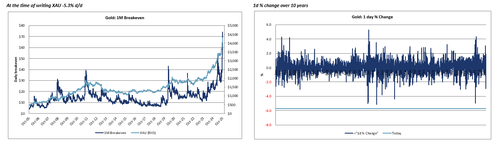

But what happened there was positively tame compared to the meltdown in gold, which slumped as much as 6.3%, a 5-sigma event and the the biggest drop in more than 12 years, while spot silver dropped as much as 8.7%. According to Goldman, the "gold chart looked like a Meme stock breaking." Shares of gold miners plummeted, too, with top producers Barrick Mining, Newmont and Agnico Eagle Mines all falling by more than 8% on Tuesday morning.

The plunge brought an abrupt halt to a surge that had seen both metals post record highs in the past week. Gold had soared both on bets the US Federal Reserve will make at least one outsized rate cut by year-end and on the so-called debasement trade, where investors have been pulling away from sovereign debt and currencies to protect from runaway budget deficits.

And since nothing there has changed and the debasement is just getting started - total US debt just hit a record high $37.98 trillion and is up $10 trillion in under 5 years...

但与黄金的暴跌相比,那里的情况确实温和得多。黄金暴跌一度暴跌6.3%,创下5西格玛事件和12年来的最大跌幅,而现货白银则一度暴跌8.7%。高盛表示,“黄金走势图看起来像是网红股的崩盘”。金矿商的股价也大幅下跌,顶级生产商巴里克矿业、纽蒙特矿业和阿格尼科鹰矿的股价周二上午均下跌超过8%。

此次暴跌戛然而止,此前两种金属均创下历史新高。此前,金价飙升,既因为押注美联储将在年底前至少进行一次大幅降息,也因为所谓的“贬值交易”(投资者纷纷抛售主权债务和货币,以防范失控的预算赤字)而大幅上涨。

而且由于什么都没有改变,美元贬值才刚刚开始——美国债务总额刚刚达到创纪录的 37.98 万亿美元,并且在不到 5 年的时间内增加了 10 万亿美元......

... the trend up and to the right will resume very shortly.

But for now, everyone wants to know what the hell happened today?

For the answer we go to Adam Gillard, specialist on the Goldman commodities desk who writes that price first drifted lower during China (aggregate open interest on SHFE -1%), before hitting stops on the London and US open.

What is most notable is that there was "no obvious smoking gun we can see" although rarely during the rally has price moved on a specific ‘headline’, rather it has been the continuation of the de-basement theme, therefore it is difficult to see what "headline" could trigger the correction.

The best answer Gillard has for the largest % move in 10 years is (simply) positioning, and that we’ve rallied for 9 consecutive weeks

Some anecdotes according to the Goldman trader:

- On days when gold rallied by ~$50/oz "we barely received any questions"

- Gold was the favored long across the franchise – on most client surveys >80% thought price would rally into year-end (including GS trading)

- We’re increasingly seeing non commodity accounts allocate – not surprising given queues for physical.

All of which meant a flush was probably inevitable according to Goldman (and our partners at SpotGamma warned one was coming).

But don't worry: just like the record levered-long crypto meltdown two weeks ago which came and went, the Goldman desk view is that the higher gold went, the wider the cohort of people who were not invested (but wanted to be) became - therefore Goldman expects to see inflows at the first signs of stability ($4,000/oz needs to hold).

……上涨和向右的趋势很快就会恢复。

但现在,每个人都想知道今天到底发生了什么?

为了找到答案,我们咨询了高盛大宗商品部门的专家亚当·吉拉德 (Adam Gillard)。他写道,价格首先在中国市场下跌(上海期货交易所总未平仓合约下跌 1%),然后在伦敦和美国开盘时触及止损点。

最值得注意的是,“我们没有看到任何明显的确凿证据”,尽管在上涨行情中,价格很少因特定的“头条新闻”而波动,而是一直在延续“去杠杆”的主题,因此很难看出哪个“头条新闻”会引发回调。

吉拉德对十年来最大百分比波动的最佳回答是(简单地说)仓位调整,我们已经连续9周上涨。

以下是这位高盛交易员的一些轶事:

在金价上涨约50美元/盎司的日子里,“我们几乎没有收到任何询问”。

黄金是整个系列中最受欢迎的多头——在大多数客户调查中,超过80%的客户认为价格会在年底前上涨(包括高盛交易)。

我们越来越多地看到非商品账户的配置——考虑到实物交易排队的情况,这并不奇怪。

根据高盛的说法,所有这些都意味着市场可能不可避免地会出现一轮上涨(我们在SpotGamma的合伙人也警告说,一轮上涨即将到来)。

但别担心:就像两周前创纪录的杠杆加密货币崩盘一样,高盛的观点是,金价越高,没有投资(但想要投资)的人群就越广泛 - 因此高盛预计在出现稳定的第一个迹象时就会看到资金流入(需要保持 4,000 美元/盎司)。

And here are some shocking charts showing how we ended up here:

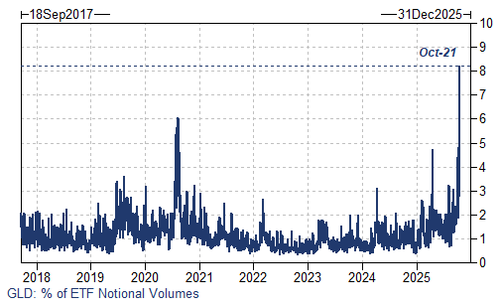

- ETF Volume: The ease of trading an ETF for quick exposure has been on full display: as of today’s close GLD accounted for 8% of all notional US-listed ETF volumes, its largest share of activity in Goldman's dataset. Flows on the ETF desk skewed (unsurprisingly) strongly better for sale today.

ETF 交易量:交易 ETF 以获得快速敞口的便利性已得到充分展示:截至今日收盘,GLD 占所有名义美国上市 ETF 交易量的 8%,在高盛的数据库中占据最大份额。ETF 交易台的资金流(不出所料)今日明显偏向于销售。

- ETF AUM: Of the total amount of inflows gathered by spot-gold ETFs over the past year, over half is attributable to demand over the past 3 months as we’ve seen a wide range of clients actively turning the dial on exposure (wealth/RIA and institutional). The velocity in which gold exposure has grown through ETFs is quite astonishing: US-listed spot-gold ETF AUM has nearly doubled since February (we warned this would happen in June).

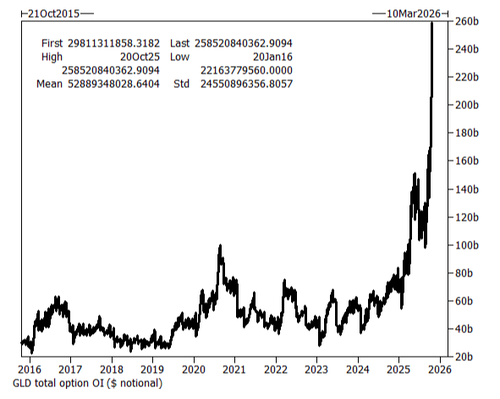

- ETF Options: GLD option Open Interest notional sits at an ATH

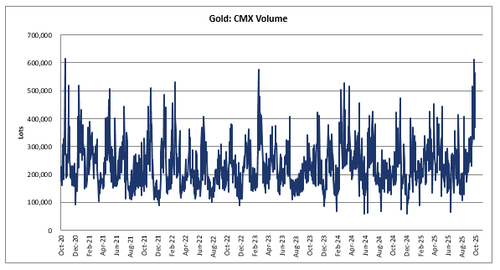

Comex 期货交易量:总交易量“仅”为 56.5 万手(撰写本文时并非年初至今的最高水平),而 MTD 预测交易量为 37.5 万手(因为仓位位于 ETF 内)

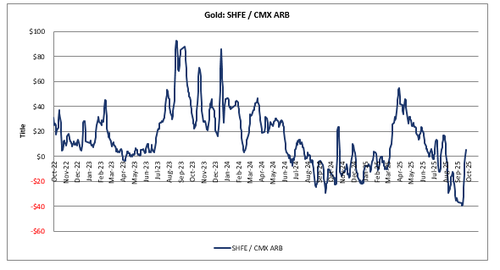

- China: Outperformed on the move lower as the SHFE / CMX arbitrage rallied to +$12/oz ; will be interesting to see if Asia physical steps-in tomorrow.